Exploring the Impact of Advanced AI Data on Forecasting and Investment Strategies

Over the past decade, real estate acquisition and investing at scale has undergone a significant transformation, largely driven by the availability of better and more diverse data sources. Historically, the homebuilding industry has adopted technological advancements at a more measured pace compared to other sectors of similar scale. However, in recent years, there has been a significant shift toward integrating data analytics into operations, demonstrating a growing commitment to modernization and enhanced efficiency. This evolution reflects the industry’s recognition of the importance of leveraging technology in real estate acquisition and investment to remain competitive in rapidly changing markets. As markets grow more complex and micro and macroeconomic trends shift frequently, leveraging data has become crucial. Today, the majority of residential homebuilders, both regionally and nationally, along with REITs, REIMs, and capital providers, utilize multiple sources of historical market data to enrich their modeling and inform real estate acquisition strategies.

How Data Has Shaped Real Estate Acquisition and Investing

Institutional investors are now embracing comprehensive datasets and predictive analytics to make more informed decisions and mitigate risks. According to McKinsey & Company, “Advanced analytics can quickly identify areas of focus, then assess the potential of a given parcel with a predictive lens.” The availability of higher quality data has empowered investors to go beyond traditional methods, allowing for more accurate market trend analysis, improved site selection, and enhanced portfolio optimization strategies. The Financial Times also notes how data is transforming real estate investing, particularly for commercial and residential developers, enabling them to gain a competitive edge in increasingly dynamic markets. By aggregating and overlaying diverse data inputs, real estate professionals are now equipped to make strategic decisions with greater confidence, fundamentally reshaping the landscape of real estate acquisition and investing.

“Advanced analytics can quickly identify areas of focus, then assess the potential of a given parcel with a predictive lens.”

Mckinsey & company

Real Estate Data Limitations: Accuracy, Actionability, and Forecasting

Data has undoubtedly enriched decision-making for large-scale real estate acquisition and investing and lending organizations across the U.S. Nonetheless, as with any industry utilizing new inputs, tools, and strategies, limitations often surface only after extensive use. The constantly evolving technology landscape introduces new tools and methods for analyzing real estate data. Unfortunately, three key limitations persist across the available tool landscape:

- Data Accuracy & Timely Relevance

Many of us have manually analyzed hundreds or thousands of deals, often leading to poor decisions. This reality holds true even when using modern technology; if the data is flawed, the outcomes will be as well. Different tools utilize various data sets, making it challenging to conduct apples-to-apples comparisons and build confidence in data-driven decision-making. - Actionable Location & Land Analysis

Asset managers, underwriters, and vice presidents of land acquisition and development must understand why specific investment opportunities are more promising than others. Relying on siloed location data and performing manual comparisons often fall short of meeting investment objectives. Running multiple real-time, side-by-side comparisons is essential for enabling smarter real estate acquisition and investing in daily operations. - Reliable Forecasting & Intelligence

Leveraging historical data—such as demographic trends, housing or rental prices, population growth and migration, zoning, and regulations—can quickly become convoluted. Current technology stacks combine these data inputs but frequently fail to transition from historical data to reliable forecasting. Effective data intelligence must not only describe the present state of the market but also provide a holistic view of various data sources, connecting the dots to generate actionable insights and reliable forecasts for superior investment decision-making.

Larger investors with national scale have tried to tackle these challenges by employing teams of data scientists to build custom models for each area of interest and investment scenario. The ever-changing nature of market factors and the unique attributes of each location mean these models require constant updates and adjustments, preventing reliable forecasting at scale. Consequently, adding a dedicated team to manage and adapt to these ongoing changes has proven inefficient and unsustainable for most real estate investors, making it difficult to scale effectively. Given the current limitations facing real estate investors, where does the land acquisition journey go from here?

The Role of AI in Democratizing Real Estate Acquisition and Investing at Scale

As real estate markets continue to evolve, a significant transformation has occurred with the democratization of data and the integration of artificial intelligence (AI) into the investment process. This shift is particularly impactful for nationally and regionally scaled residential home builders, REITs, REIMs, and capital providers. Traditionally, real estate acquisition and investing required access to exclusive data sources and extensive personal networks, often favoring large institutional investors with vast resources. However, AI-powered real estate platforms are enabling a broader range of market participants to harness sophisticated insights that were once reserved for industry elites. By leveraging AI-driven real estate insights, these platforms allow a diverse set of investors to effectively engage in real estate investment strategies using AI.

The integration of AI into the real estate investing process is changing how investments are evaluated and executed. With the capability to analyze vast quantities of data, AI-driven tools can automate real estate acquisition and investing, providing actionable intelligence and insights that enhance decision-making. This revolution is not only making the investment process more efficient but also increasing the accessibility of real estate investment tools for investors of all sizes.

Predictive analytics in real estate markets is an area where AI shines, enabling investors to anticipate future market trends based on historical data and real-time inputs. This capability enhances strategic planning and allows investors to make informed decisions, reducing the reliance on outdated or inaccurate information. As more players in the real estate investment landscape embrace these technologies, the overall competitiveness of the market will continue to intensify.

Learn more about the intelligent insights of predictive analytics with Slate.ai on their REI webinar: Watch the recording

In conclusion, the evolution of data and AI is fundamentally transforming the real estate acquisition and investing landscape, making it more accessible and efficient for a broader range of investors. By harnessing AI and predictive analytics, professionals in the industry can navigate complex market dynamics, identify promising investment opportunities, and ultimately drive better outcomes for their stakeholders.

Enhancing Real Estate Returns with AI: Strategies for Modern Investors

AI-driven platforms empower organizations in the real estate investing landscape to process vast amounts of data rapidly, aggregating information from diverse sources—historical pricing trends, demographic shifts, zoning regulations, and migration patterns—allowing for highly informed decision-making. According to a Forbes article, AI in real estate is empowering investors to make more accurate predictions about future market trends and asset values, based on a combination of historical data and real-time insights. This enhanced predictive capability enables residential builders, REITs, and capital providers to anticipate market shifts and capitalize on opportunities ahead of their competitors.

For residential home builders operating at both national and regional scales, AI has streamlined the identification of high-growth markets and the assessment of land potential. The once time-consuming process of comparing various properties across multiple markets is now efficient and scalable. Furthermore, capital providers are better equipped to evaluate loan risk and investment viability by leveraging AI insights to analyze trends and forecast future performance. Predictive analytics in real estate markets has become a cornerstone of effective investment strategies, allowing organizations to harness the power of data in real time.

AI also plays a critical role in refining risk management for REITs and REIMs. Traditional models often relied on historical data, making them reactive to market changes. In contrast, AI allows real estate professionals to adopt a proactive approach by analyzing multiple risk factors in real time—such as fluctuating interest rates, evolving regulations, or changing demand dynamics. An article from Deloitte suggests that AI is beginning to redefine how risk is measured and mitigated when analyzing investment options, offering a significant advantage to firms that adopt these technologies early.

As AI technology continues to advance, its integration into all facets of real estate investment—from construction planning and site selection to tenant behavior analysis and property management—will only deepen. The future of residential real estate acquisition and investing will undoubtedly be shaped by data, with AI acting as a key driver and catalyst that makes this data actionable at scale. By embracing these technological advancements, residential builders, REITs, REIMs, and capital providers will be better positioned to navigate the complexities of the market, capitalize on emerging opportunities, and mitigate risks in an increasingly competitive landscape.

ONX Homes: Empowering Smart Land Acquisition Through AI-Driven Insights

ONX Homes is an innovative, vertically integrated homebuilder that utilizes X+ Construction Technology to sustainably construct single-family homes with speed and scale. The company aimed to swiftly identify high-potential markets in Florida and Texas, pinpoint promising areas for land acquisition, and compare various zip codes based on population shifts, income growth, sales velocity, and pricing sensitivity.

Read the full case study for ONX and Slate.ai to see how they create more value with real estate intelligence tools.

DOWNLOAD THE CASE STUDY

Confronted with challenges like a limited supply of buildable land and uncertainty surrounding land value, ONX realized traditional land acquisition methods—often reliant on personal networks and regional knowledge—were time-consuming, costly, and not scalable. To address these obstacles, ONX sought an all-in-one real estate intelligence platform that leverages AI to deliver real-time data, predictive analytics, and automate real estate acquisition and investing. This would enable comprehensive market analyses and facilitate “what-if” scenarios for potential investments. Their goal was to not only compare potential investments but also anticipate the impact of changing variables such as population growth, housing prices, and interest rates, ultimately enhancing confidence in their models and minimizing risk.

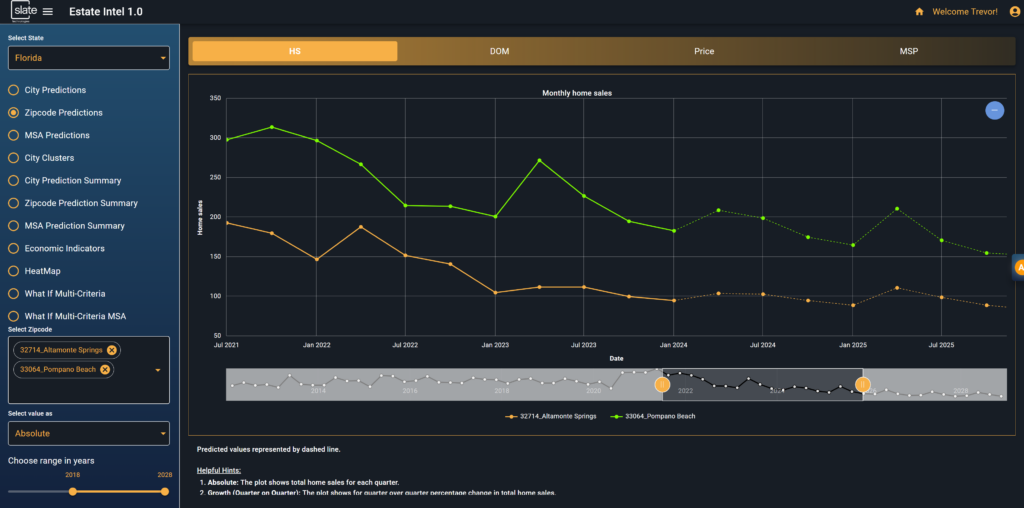

ONX utilized Slate’s Real Estate Intelligence platform, which aggregates over 100 unique data sources, ensuring data input accuracy and timely relevance. Slate’s platform enabled ONX to not only unify real-time data but also run side-by-side comparisons, generate actionable insights, and visualize data through heatmaps. This significantly accelerated the collaborative process among the ONX investor team.

As a result, ONX invested in several growth areas in Southern Florida and identified optimal locations for factories to support their offsite, prefabricated approach. This strategy allowed them to meet homebuyer needs more quickly and effectively, at the right price, with the right product.

“There is a lot of data available in our industry, but there isn’t a single product that is credibly predictive. “

Steve weilbach, vp of sales and business at onx homes

Steve Weilbach, VP of Sales and Business Development at ONX Homes, summarized his team’s initial experience with AI-powered market analysis: “There is a lot of data available in our industry, but there isn’t a single product that is credibly predictive. Real estate intelligence will be a game changer, allowing investors to look to the future rather than the past in identifying where and when to make the best acquisitions.”

Read the entire case study here: Real Estate Intelligence Case Study for ONX by Slate.ai

Real Estate Investing is Evolving: From Historical Analysis to Predictive Insights

The transformative power of advanced data has already revolutionized numerous industries, from Wall Street’s financial markets to supply chain management, healthcare, retail, and manufacturing. These sectors have enhanced decision-making and operational efficiency while effectively mitigating risk. Now, the real estate investment sector stands on the brink of a similar transformation. As early adopters embrace advanced data analytics, they gain a significant competitive edge through leveraging comprehensive insights to navigate complex market dynamics and shifting economic trends.

Real estate investors traditionally relied heavily on historical data and market trends to make decisions. Yet, this approach often left them vulnerable to sudden market shifts and emerging opportunities. Now, with the proliferation of big data, machine learning, and artificial intelligence (AI), investors can move beyond reactive strategies. By incorporating predictive analytics, they can anticipate future market conditions, tenant behaviors, and property valuations. This proactive approach allows investors to identify profitable opportunities before their competitors and adjust their strategies in real time, ensuring they remain agile in a rapidly changing environment.

Moreover, the integration of various data sources—from demographic trends and economic indicators to environmental factors—enables a more holistic view of the market landscape. By synthesizing these insights, investors can refine their asset allocation strategies, optimize their portfolio performance, and enhance risk management practices. With the right market analysis tools for real estate, the future of investing promises to be more precise, predictive, and prosperous. Investors who embrace AI as a foundational aspect of their analysis and investment strategy will be well-positioned to outperform those who fail to adapt to the evolution of data.

About Slate Technologies

Slate Technologies’ Real Estate Intelligence is a cutting-edge, AI-driven platform that is transforming real estate acquisitions and investment by providing real-time data, predictive analytics, and actionable insights.

Download Slate’s Real Estate Intelligence Product Guide

Designed specifically for investors and developers, Slate enables faster, data-driven decision-making by consolidating multiple data sources and offering tools for market analysis, side-by-side comparisons, “what-if” scenarios, risk assessment, and forecasting. Our platform empowers real estate professionals to identify high-potential opportunities, optimize investment strategies, and mitigate risks, allowing them to move beyond traditional methods and embrace a future of smarter, more confident decision-making through data.

Request a demo of Real Estate Intelligence with the team at Slate.ai

Sources:

https://slate.ai/real-estate-intelligence/

https://slate.ai/wp-content/uploads/2024/09/Slate_CaseStudy_REI_2024.pdf

https://forbes.co.il/e/buying-or-selling-property-heres-how-ai-can-help/