New Survey Reveals Industry’s Tech Transformation Divide

The construction and real estate industry is undergoing a digital shift—but is it happening fast enough? A recent industry survey conducted by Slate Technologies sheds light on how construction leaders perceive the role of AI in construction, where the gaps lie, and what it will take to fully embrace digital transformation.

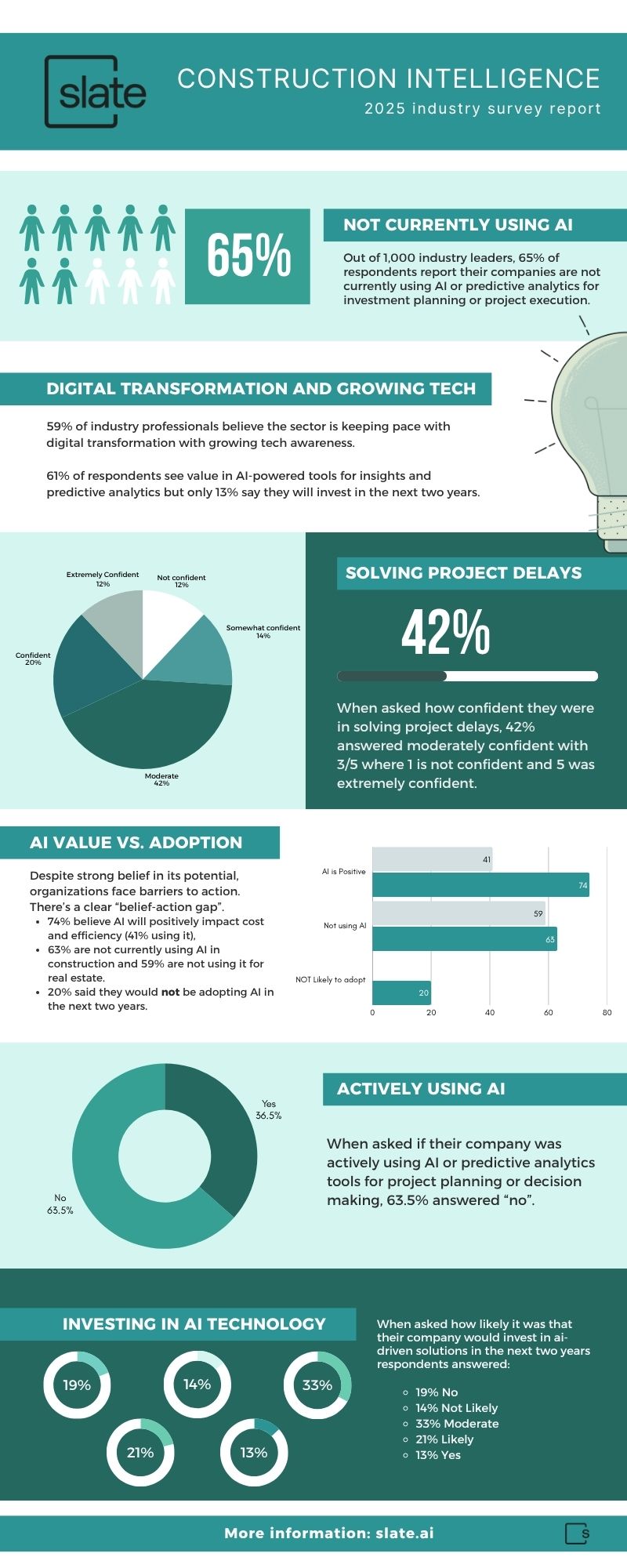

In this “Construction Intelligence” study, Slate surveyed 1,000 industry leaders in construction, real estate, and investment. Designed to be an ongoing initiative, the study aims to capture and analyze the perspectives of those leading the industry to provide a snapshot of priorities, challenges, and opportunities. Noting the urgency around evolving supply chain dynamics, shifting tariffs, persistent material shortages, and accelerating technological advancement—Slate continues to track how decision-makers are adapting and where they see the greatest need for innovation.

Who is Slate Technologies?

Slate is an AI-powered software platform that connects to your existing technology systems to create intelligence insights and recommendations. Learn from previous projects and never make the same mistake twice. Our Project Intelligence tool utilizes past project data to build a database of lessons learned. This is then combined with project information to inform your team of critical patterns effecting delays, rework, budgets, schedules, and identify project risk. Keep your current tech stack, Slate connects with systems like Procore, Autodesk, P6, and others to analyze project data. We partner with your construction company to reveal hidden efficiencies and enable revenue streams to stay ahead of risk and avoid delays.

Digital Transformation: AI in Construction Gaining Momentum

Our data shows that 59% of industry professionals believe the sector is keeping pace with digital transformation, a promising sign of growing tech awareness. But when we looked deeper, a surprising insight emerged: 65% of respondents report their companies are not currently using AI or predictive analytics for investment planning or project execution.

65% of respondents report their companies are not currently using AI or predictive analytics

Slate 2025 Construction intelligence study

This disconnect suggests that while conversations around construction technology are growing, implementation of ai in preconstruction is lagging behind. The potential is recognized—but action is still tentative.

AI in Construction: Seen as Valuable, Yet Underutilized

When asked about the impact of AI and automation on efficiency and cost control over the next five years, more than 74% of respondents rated the impact as a 3 or higher, indicating broad agreement that AI will play a major role in reshaping project outcomes.

However, when it comes to immediate investments in AI, only 13% said their companies are extremely likely to adopt AI-driven solutions within the next two years. This “wait-and-see” attitude points to an opportunity for industry education and better demonstration of ROI from AI platforms.

At the same time, 61% of construction leaders do see clear value in AI tools that provide real-time market insights and predictive analytics for better decision-making. The interest is there—what’s needed now is trust, usability, and a clear roadmap for integration.

Material Costs Take Priority Over Labor Shortages

One of the most striking findings from the survey was the shift in top concerns. While labor shortages often dominate industry headlines, the data tells a different story:

- 53% of respondents rated rising material costs as a major impact (4 or 5 on a 5-point scale)

- Only 35% rated labor shortages as highly impactful

This highlights an urgent need for smarter construction planning tools that can help manage material sourcing, cost volatility, and supply chain disruptions.

Project Delays Remain a Persistent Challenge

Confidence in a company’s ability to mitigate delays is lukewarm at best. Only 20% of respondents said they are highly confident in their organization’s ability to avoid or recover from schedule setbacks. A majority—42%—reported only moderate confidence in their delay mitigation strategies.

This underscores a need for more real-time project monitoring and predictive scheduling tools that use AI to identify risks early and recommend proactive solutions. Slate’s CEO, Trevor Schick commented on how AI in construction is revolutionizing the industry in a previous editorial piece earlier this year. Read the full article in Slate’s news archive.

This report holds a surprising trend that must be noted by all players who want to succeed in today’s market: action is necessary. While the need to make smart decisions is incredibly important, the lack of action to adopt technology will be a critical error. Systems and software that analyze project outcomes provides objective data that shows clear opportunities to improve operations.

Forecasting and Budgeting Tools: A Weak Spot with High Stakes

Nearly half of construction professionals say current project forecasting and budgeting tools do not provide accurate cost or timeline estimates. This lack of reliability in the preconstruction phase can lead to downstream issues like over-budget projects and missed deadlines.

AI-driven platforms like those developed by Slate Technologies aim to address this challenge by integrating data from across the project lifecycle—giving teams a more accurate, unified view from day one.

Construction Intelligence Survey Trends

Industry leaders responded to a survey asking about AI in construction. Responses addressed if they felt confident about it, if they thought it would help solve some critical problems in the industry, and if they thought they would adopt the technology. Amidst economic volatility, having tools for predictive insight and analyzing trends in the market can provide relief and even show clear steps for how to avoid catastrophe. Responses show clear confusion on a way forward. If you were given a tool to help improve your business operations, why would you choose to ignore it?

Here are the top 5 response trends that Slate found after sending this Construction Intelligence Survey to 1,000 industry leaders:

🔍 1. AI Value Perception vs. Adoption Lag

- Insight: There’s a clear “belief-action gap.”

- 74% believe AI will positively impact cost and efficiency.

- Yet 65% are not currently using AI or predictive analytics.

- Only 13% are “very likely” to adopt it in two years.

- Implication: Despite strong belief in its potential, organizations face barriers to action, likely due to cultural inertia, lack of technical capability, or uncertainty about ROI.

📉 2. Confidence Gaps in Project Delivery

- Only 20% of respondents feel highly confident in mitigating delays.

- 42% report moderate confidence, implying the rest (nearly 40%) feel low or no confidence.

- Implication: This signals a strategic opportunity for AI tools to improve scheduling accuracy, resource planning, and real-time risk alerts.

🛠️ 3. Mismatch in Perceived Challenges vs. AI Applications

- Top concern: Material costs (53%) – a macroeconomic issue that’s hard to control.

- Labor shortages (35%) rank lower, but are more addressable via automation and AI.

- Implication: Companies may be underestimating the role of AI in resolving challenges they don’t rank as critical, such as labor productivity, forecasting, or procurement optimization.

📊 4. Digital Transformation Attitudes Are Positive, But Incomplete

- 59% feel the industry is keeping pace with digital transformation.

- However, the low AI adoption and confidence in project delivery suggest that transformation is partial—more evident in documentation and communication, less so in decision-making intelligence.

💡 5. Emerging Trend: Demand for Predictive Insights

- 61% see value in real-time market insights and predictive analytics.

- This is a signal of rising demand for forward-looking intelligence, especially amidst economic volatility.

- Implication: This could be a key entry point for AI adoption—focusing on tools that offer market foresight, not just internal project optimization

Summary of Construction Intelligence Survey Response Trends

| Trend | Key Statistic | Strategic Insight |

|---|---|---|

| Belief-action gap | 74% see value, only 13% plan adoption | AI evangelism isn’t converting to implementation |

| Confidence shortfall | Only 20% are highly confident | A major risk mitigation opportunity for AI |

| Cost concerns misaligned | Material cost is top concern, not labor | Yet labor is where AI can show faster ROI |

| Predictive demand growing | 61% want market/predictive insights | Indicates readiness for AI that looks ahead |

The Takeaway: Awareness Is High but Action Must Follow

The construction industry is no longer ignoring digital innovation. Leaders see the value in AI in construction, predictive analytics, and automation—but hesitation remains when it comes to execution.

If you’re among the 61% who believe AI-powered tools can transform planning and performance, the next step is clear: start exploring real-world applications today. The technology is ready—and the industry can’t afford to wait. Utilizing AI doesn’t have to be complicated. With companies like Slate Technologies that partner with your team to improve project delivery; its as simple as scheduling a short phone call to explore the opportunity and see just how seamless AI-powered data can be.

Read more responses about Slate’s Construction Intelligence Study from these industry media outlets:

About Slate Technologies

Slate Technologies is redefining how the construction industry operates through intelligent automation and data integration. Our advanced software platform unifies data from previously siloed sources that span preconstruction, schedules, construction project execution, and warranty into a single, comprehensive system of intelligence. By providing decision-makers with a more clear view of every project, Slate empowers construction teams to work more efficiently, mitigate risk, and improve outcomes at every stage of the project lifecycle. This is done without impacting construction teams current processes by partnering with Slate to utilize current project data to inform future optimization with innovative AI-powered insights.

Contact Slate’s team today to learn more about optimizing your construction project data and connecting tools like Procore, Autodesk, P6 and more.